The U.S. government will rescue former customers of Silicon Valley Bank, but its collapse has shaken the global startup market and the foundations of at least 10,000 companies. Now both large corporations and small organizations have problems. The mood is poor, and development budgets are shrinking.

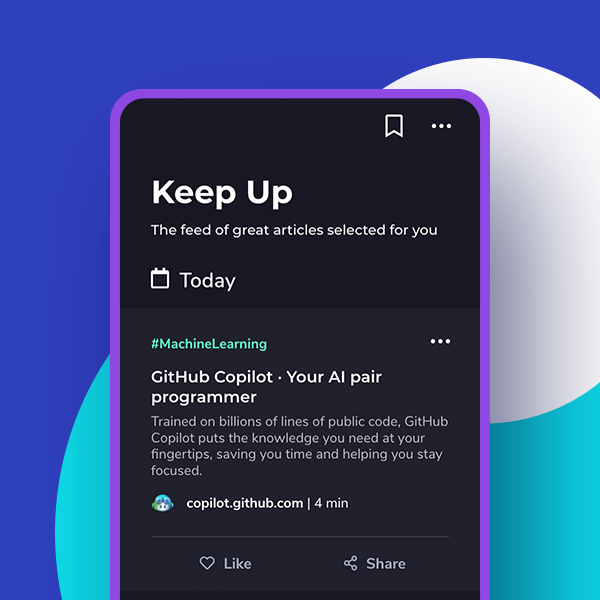

Following the footsteps of Arthur and his Software Craftsmanship Weekly, I have decided to cover just one topic today – the echoes of the Silicon Valley Bank collapse in the startup world. I hope this will be an interesting follow-up to the weekend’s sensations.

Y Combinator cuts funding

One clear sign that funding sources are drying up in Silicon Valley (or at least that cash levels have fallen sharply) is the latest announcement from Y Combinator. The world’s most famous startup accelerator has announced that it is cutting back on funding for advanced-stage startups and reducing its team.

Representatives of Y Combinator deny that their decision has anything to do with the collapse of SVB and was considered far earlier. They remind us that their specialty is supporting early-stage startups, so the remaining investments were merely “distractions from the main mission”. On the other hand, as many as 30% of the startups supported by Y Combinator had their funds in SVB and were exposed to illiquidity.

All this means that enthusiastic predictions about the safety of small companies should be put between fairy tales. At the beginning of the wave of layoffs in Big Tech, there was a lot of talk that they would be the ones to attract the talent that corporations said goodbye to. Now there can be considerable doubt about that. The shadow of SVB’s fail will hover over startups for a long time to come, raising questions about whether it’s worth swapping unstable ground… for even more unstable ground.

Will the government let the founders sleep soundly?

Startups storing money in SVB may find it difficult to continue their growth and maintain their teams. Y Combinator, in a petition to the U.S. government, mentions that the bank’s collapse has threatened 10,000 micro-businesses that will not be able to pay their employees for the next month. These threats affect as many as 100,000 people.

A petition signed by several thousand representatives of startups was promptly answered by the US Treasury, the Federal Reserve and the Federal Deposit Insurance Corp. The state regulator will support SVB deposits above the $250,000 ceiling, meaning that uninsured funds will not be lost to bank customers. As a result, startup founders can (temporarily) breathe a sigh of relief and prepare for the extremely difficult task of rebuilding trust – both among customers and within their own teams. At the same time, they must reckon with the fact that the funds will not be paid out “right away” and keep their fingers crossed that government institutions will manage to pay out deposits before the company’s situation becomes critical.

And what about Silicon Valley Bank’s employees? A helping hand has been extended to them as well. The Federal Deposit Insurance Corp. is encouraging them to temporarily remain within the structures of the bankrupt entity to “stabilize the situation”. These individuals are expected to work for the next 45 days at one-and-a-half times their current rate – either remotely or at individual branches. It’s worth noting that at the end of last year, SVB employed some 8,500 people. That’s not bad, even from the perspective of the wave of layoffs in the US!

Or maybe this is just the beginning…

The events of recent days are not the only “trouble” in the context of startup finance.

Bad news is coming from a number of industries, but the performance of fintechs, whose shares have fallen as much as 72% in 2022, is particularly worrisome. After peaking at $1.3 trillion at the end of 2021, the F-Prime Fintech Index scored a dive to $397 billion by the end of 2022. The data is troubling because the Fintech Index covers 55 companies in the B2B SAAS, payments, banking, wealth and asset management, lending and insurance sectors. In short, it gathers information from a very wide range of financial companies.

These and other indicators, as well as opinions gathered at least on LinkedIn or Ben Thompson’s blog, suggest that we are in for some really dynamic times and a lot of uncertainty in the market.

Why am I writing about all this? Well, uncertainty leads to cutting budgets, and with smaller budgets it’s hard to continue developing digital products. Unfortunately, this can affect the number of job offers for developers. If you have a safe haven, it’s rather better to stay in it.

Sources:

- https://techcrunch.com/2023/03/13/y-combinator-cuts-nearly-20-of-staff-scales-back-growth-stage-investments/

- https://www.nbcnews.com/business/business-news/treasury-says-will-back-silicon-valley-bank-deposits-rcna74570

- https://techcrunch.com/2023/03/12/fintech-interchange-svb-implosion-impact/

- https://www.linkedin.com/news/story/startups-scramble-after-svb-collapse-5571796/

- https://stratechery.com/2023/the-death-of-silicon-valley-bank/